Imagine earning income from somewhere else than through a job or contracting. Yes, I am talking about Passive Income. Generating earnings from savings and investments is what I will try to break into an easy to follow guide so that you can get started today. All with the goal of becoming wealthier.

Why £5 a day?

Putting money aside each day for investing can help grow passive income for life. The more you put aside the better odds you have at creating a nice nest egg (income) to enjoy life. Saving £5 per day is taken with the notion that this amount should not drastically change your daily spending behavior while creating a growing investment portfolio.

Saving £5 per day is the same as £1,825 a year or approximately £152 a month.

When should I invest my savings?

One might argue that saving a lump sum of £1,825 each year is the same as £5 a day. Strictly speaking that may be true but the goal here is to make investing more practical so you start building your passive income today, not tomorrow.

Buying for £5 each day is not practical and only trading once per year means your savings not generating value. Instead invest each month as discussed in Invest Your Money Over Time. Investing the £152 each month means your money starts working almost straight away. Buying on a monthly schedule also has the benefit of averaging the cost of the shares you are investing in. In this way you end up buying the shares at different prices from month to month.

Reinvesting

Putting your money to work and reinvesting any profits will help compound the value of your investment holdings. This means keeping any profits you make from buying and selling AND any dividends received. Over time this should result in a decent return on investment. Some investment providers provide the option to automatically reinvest any dividends received so you do not need to take manual actions each time a dividend is paid out.

Keeping your initial savings and profits in the portfolio will enable you to accumulate a larger investment portfolio over time. When time is right you may choose to pay out profits partially or fully.

The Power of Compounding Interest

Interested in knowing how long it takes to double or quadruple your money? The return on your investments will determine how long it takes for your money to double in value. In the article on Compound Interest I cover this topic in more detail if you are interested.

It can be tempting to pick the stock that has provided the highest return in stock price or stock with highest dividend yield beware of the risks involved with the investments you have chosen. There is no guarantee that your investment will continue to go up or down.

Expected Return

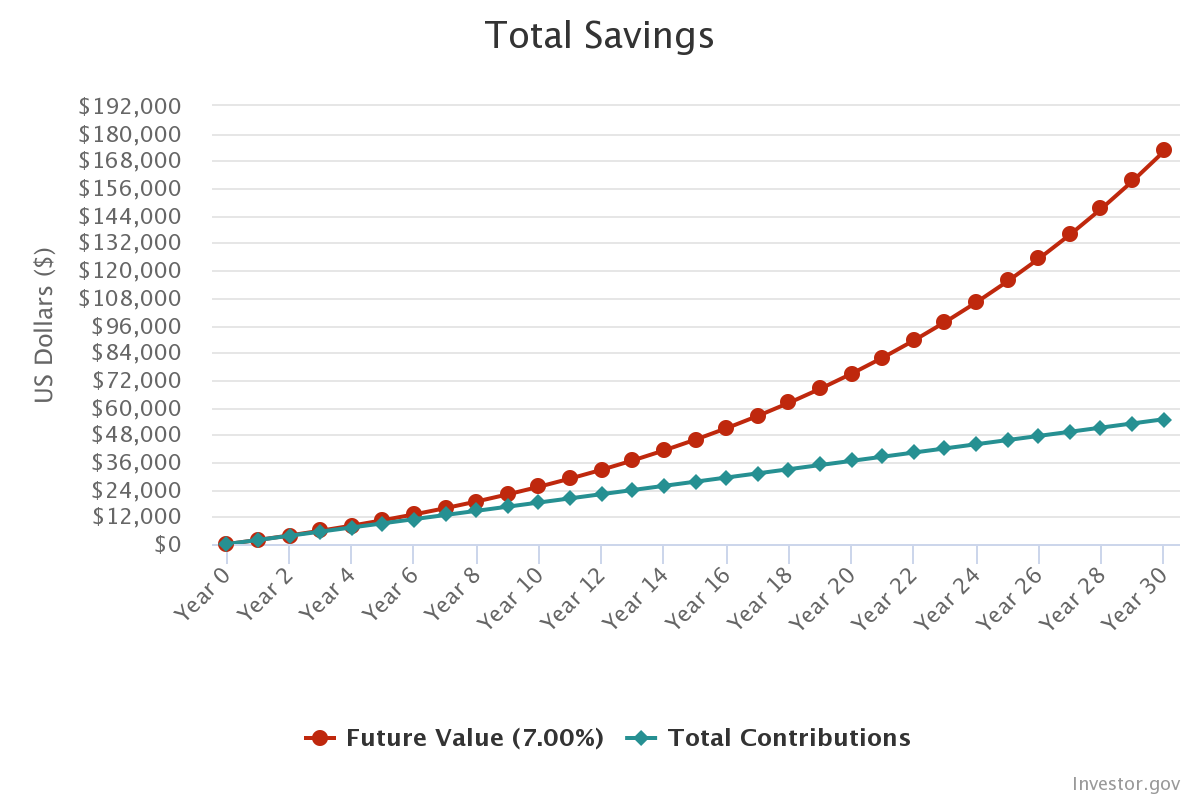

The average yearly return of S&P 500 has been around 7% between 1970 and 2022. Using this assumption for return we can calculate the projected returns over a 30 year period.

Investing just 5 each day means you could accumulate approximately 172,300 by year 30. Of this amount, your total contributions of 54,720 will have made 117.580 in gains.